Transforming Investing with AI

Founded in 2016 and backed by SoftBank Group since 2022, Qraft Technologies has dedicated nearly a decade to a singular mission: exploring how AI can reshape the future of asset management.

Qraft Technologies

Built on large-scale data pipelines and a highly automated quantitative research and execution process powered by AI, Qraft continuously seeks to uncover subtle, non-random patterns within market data that remain beyond the reach of traditional methodologies. By transforming these insights into predictive signals and systematic trading strategies, Qraft delivers repeatable and scalable investment performance across asset management and capital markets.

News Coverages

We have been featured in leading global media outlets for our advancements in AI, quantitative investing, and financial technology.

“Only one, Qraft AI-Enhanced US Large Cap Strategy, stands out for performance. But that should change in time, as more funds launch and the AIs “learn”…”

“SoftBank Group is investing $146 million in Qraft Technologies to gain access to the money manager’s AI tools and help seed the startup’s growth…”

“One of Qraft's missions is to democratize quant investing by applying an artificial intelligence model to portfolio construction via an investment product…”

Our Businesses

AI Hedge Fund

Systematic strategies powered by proprietary AI research and disciplined risk management.

AI Quantitative Investment Solutions

Tailored AI solutions align with clients’ risk and return goals. LLMs create clear, explainable reports.

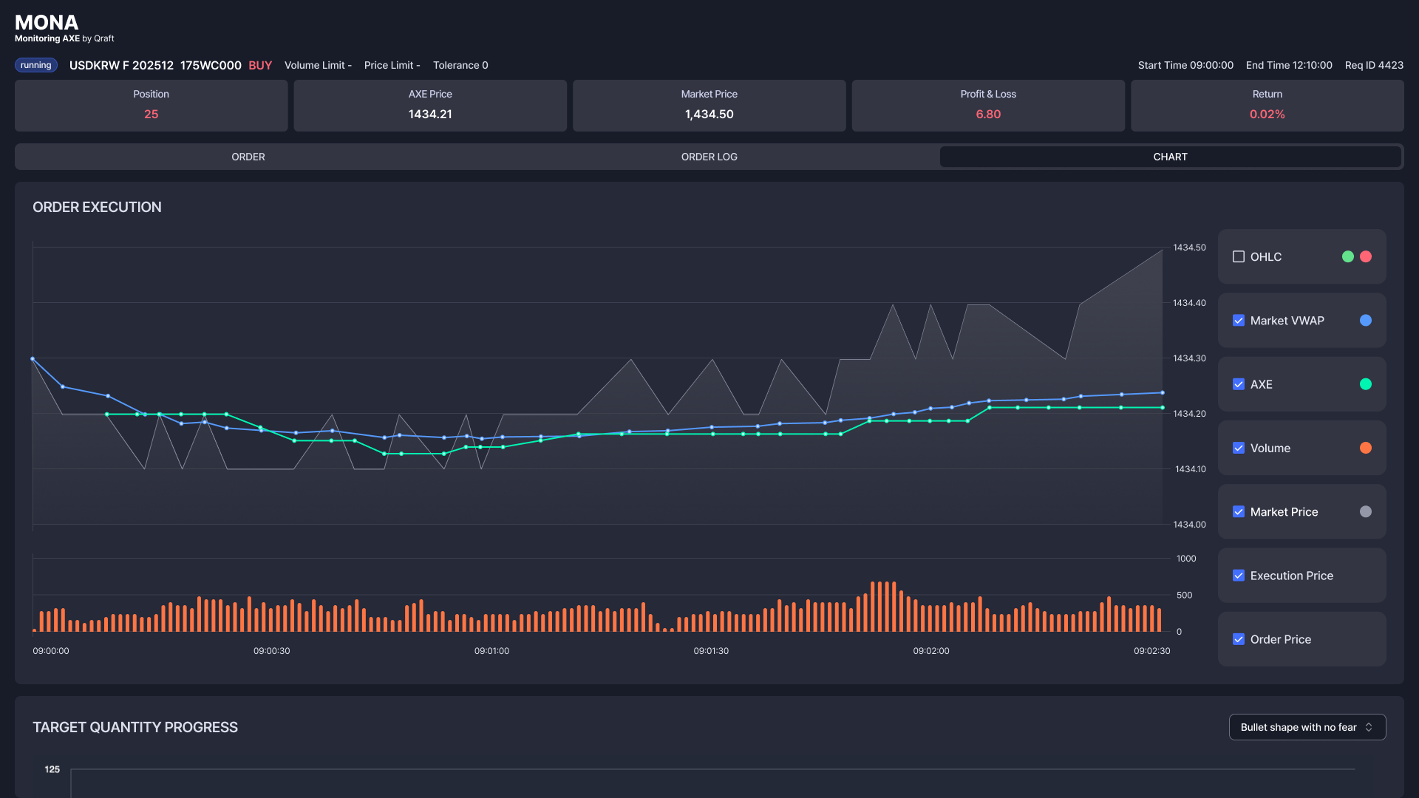

Market Intelligence and Execution

We deliver AI trading algorithms and automated report generation via our MONA platform.